Cash Savings → High Income and Safety

Maybe it’s your emergency fund. Maybe it’s your savings for near-term expenses. The stock market is WAY too risky in the short-term, so where can you safely park your cash that also earns a decent yield? This report reviews two compelling options (Vanguard bond ETFs) for you to consider. I use them both regularly.

The Lay of the Land:

To understand why these two Vanguard Bond ETFs are attractive, it’s worth comparing them to your other options first. For example…

Hiding cash under your mattress: This is very safe (as long as no one breaks into your home and steals it). But it doesn’t pay any interest (that is the opportunity cost), and with inflation around 3% a year, the value of cash under your mattress actually DECREASES over time. Yuck!

A Certificate of Deposit (“CD”) at a Bank: You can drive over to your local bank, make small talk with whoever is working in the office that day, and get around 3.5% to 4.0% for locking your cash up in a CD for 3 to 12 months. Important to note, the 3.5% to 4% is an annualized rate, so if you buy a 6 month CD you actually only get half of the rate (so 1.75% to 2.0%, in our example). Further, you have to remember to go back to the bank and renew (rollover) the CD when it matures (otherwise they pay you close to 0% interest), and if you pull your money out early then you may end up forfeiting the interest you earned—yuck! CD’s are typically guaranteed by the bank (and the Federal Deposit Insurance Corporation, FDIC) up to $250,000, so if the bank defaults you still get your money.

US Treasury Bonds: These are backed by the full faith and credit of the US government, but they currently offer slightly lower interest rates than the CDs, and you still have to lock your money up until the bond matures (because if you sell it early you may get less money than you are expecting depending on where market interest rates are on any particular day—and this risk increases depending on the duration of the bond—the longer, the riskier). So if you are comfortable with this risk, and the inconvenience of remembering to buy a new bond each time one of your existing bonds matures—then this may be just an “okay” option.

High-Yield Savings at a Bank: These are mostly advertising ploys with teaser rates to lure you into a bank as a new customer, and then stick you with a lower rate if you don’t jump through all their hoops, and you probably still get a lower rate after their initial promotional rate expires. This can be a decent option, but caveat emptor (buyer beware!).

Vanguard Bond ETFs:

An ETF is an exchange-traded fund, which is basically a basket of investments managed professionally. And in the case of Vanguard, the following two bond ETFs are attractive and worth considering.

Vanguard Short-Term Corporate Bond Index Fund ETF (VCSH):

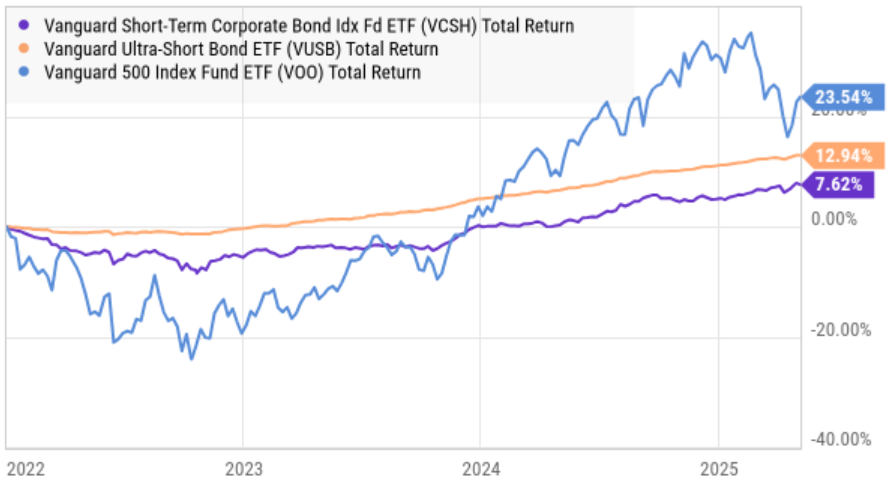

So this one holds around 2,500 individual bonds (mostly investment grade) with maturities typically between 1 d 5 years. The current yield (paid monthly) is around 4.4% (so you get 1/12th of that each month), which isn’t bad. And even though the price of this fund can move around a bit over time (see chart below) you can cash out on any day you want (i.e. you don’t have to hold to some future maturity date). It’s fairly convenient, very low risk (compared to the stock market), and the yield is nice.

Vanguard Ultra-Short Bond ETF Shares (VUSB):

This one provides a bit higher yield (currently around 4.8%), and its goal is to provide current income while maintaining limited price volatility, which it has done as you can see in the chart below. VUSB holds around 870 bonds mostly high-quality (and to a lessor extent, medium quality), but because it is diversified—it does a great job of providing current income and low price volatility (it is WAY less volatile than the stock market (S&P 500), as you can see in the chart below). It also has shorter-term bonds than VCSH (above) which means it has less interest rate risk (i.e. it should be less volatile—which it has been).

The Bottom Line:

If you are looking for a “safe” place to stick your short-term cash, I like these two Vanguard Bond ETFs for the high income, low price volatility and daily liquidity (i.e. you don’t have to hold them until some future maturity date, like CDs and single treasury bonds, and there is no penalty for “early withdrawal” or failing to roll them over (they never mature)). They’re also a lot better than sticking cash under your mattress (because you don’t have to worry about inflation eating away at the value of your money, or bad guys breaking in and stealing them).

At the end of the day, you need to build and prudently-diversified portfolio that is right for you and your own personal situation. Vanguard bond ETFs are worth considering.